Developing a framework for climate-related risk

On an almost daily basis, we can see the devastation climate related events have on our world. Yet as communities battle with the catastrophic impact of storms, floods and bush fires, another threat is emerging: how to manage the risk to the global economy and financial stability.

The severity of the threat to financial stability has shifted the agenda from whether central banks and regulators should act on the climate crisis to what measures ought to be put in place. While financial institutions can expect a significant increase in regulatory focus, the complexities supervisory authorities now face in monitoring the physical, liability and transition risks posed by climate-related threats creates several challenges to implementation.

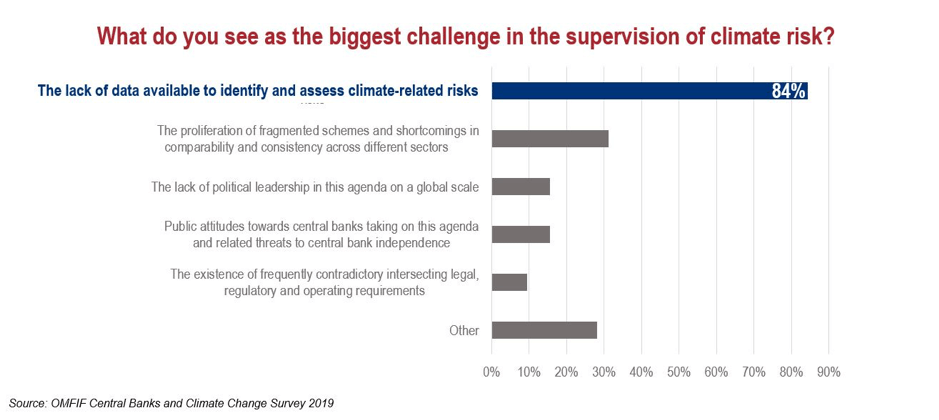

A global survey of 33 central banks in six regions by Mazars and the Official Monetary and Financial Institutions Forum (OMFIF) highlighted significant hurdles to developing a framework to manage and supervise climate related risk. They include a lack of climate-risk data at firm level (Figure 1), disagreement over mandate and responsibilities, and a lack of harmonisation on green investment taxonomies.

Figure 1

Financial system exposures

For financial firms and investors, the ability to quantify exposure to climate related risks is vital – particularly as the regulatory dial shifts to a greener investment landscape, where the danger of holding stranded assets is a significant risk for the banking and asset management industry. This shift not only affects their capacity to generate returns but also their ability to meet capital requirements set by regulators.

For insurance companies, climate related claims or liabilities can be managed to some extent through catastrophe bonds or other financial instruments. However, the growing number and severity of natural catastrophe events also require insurance companies to explore a broader range of tools to manage their natural catastrophe risk exposure more effectively.

Failure by financial services firms and regulators to monitor and manage climate risk exposures could result in significant damage to global economies. Also, rising insurance costs and unmanageable claims, asset value destruction, and vastly reduced investment performance could impact the overall stability of the financial system. The question now is: how do we begin to manage these risks?

Reaction from regulators

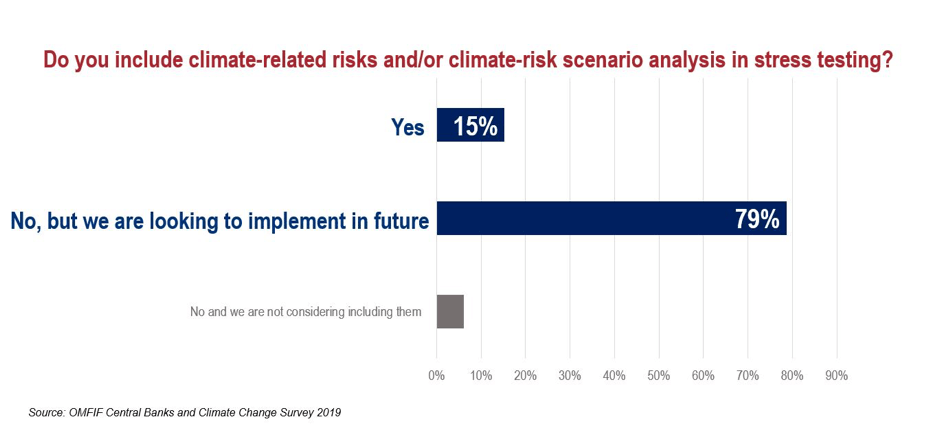

As the Mazars report identifies, a consistent approach by regulators to supervise climate risk is still some way off. While central banks are looking to implement models, the sheer scale, speed and complexity of climate risks pose unique challenges for stress testing and modelling. According to the report, to date, a minority of central banks and regulators surveyed are currently conducting climate-related scenario analyses in their routine stress tests (Figure 2).

One barrier to implementation is the growing consensus that conventional macroeconomic models are inadequate. Instead, integrating climate risk scenario analyses into standard stress tests requires drawing from alternative techniques, such as stock-flow consistent and agent-based modelling. There’s a growing appetite for an approach that also factors in the opportunities created as the investment landscape moves from brown to green.

Figure 2

Rewarding positive behaviour

Initiatives such as the European Green Deal focus on making changes that protect the environment, as well as supporting positive societal and economic change. As investments in clean technology or sustainable projects are given a more prominent platform, there is potential for investment growth and new business opportunities to expand.

By rewarding positive behaviour, such initiatives have a significant role to play in reducing the overall risk of climate-related events as societies transition to a greener way of living. Importantly, it also drives positive behaviours at firm level as it encourages the financial services industry to transition business operations towards a more sustainable economic future.

Looking ahead, financial firms that embrace green investment taxonomies and promote societal improvements will help to reduce the need for market and regulatory intervention.

The impact on reporting

As the regulatory landscape reacts and adapts to climate-related threats, CFOs and accountancy firms will need a framework that adopts the right balance of financial and nonfinancial reporting requirements. While the industry can expect more stringent regulation on stress-testing and modelling specific climate-related scenarios, there is also a need to assess non-financial exposures relating to legislative or practice-led changes on environmental issues.

At firm level, this may involve questions on whether a policy change is likely to impact future business strategies and firm sustainability. A standardised approach to categorising different impacts and harmonising definitions is essential. According to the Mazars’ report, “the lack of harmonised definitions is an important deterrent for establishing, in a comparable manner, which activities and sectors should be considered aligned with the goals of environmental sustainability, and therefore to assess institutions’ exposure to climate risk.”

Looking ahead

As we move into an era when environmental and societal issues are connected more than ever to the business landscape, it is vital that financial institutions now collaborate and pull together with regulatory authorities and professional bodies to work towards a more sustainable future for all.

As a respected global financial hub, Dublin can take the lead on moving the conversation forward and help companies explore approaches to managing climate risk. It is also an opportunity to think about long-term sustainability issues that will help to enhance shareholder value.

By asking the right questions, we can begin to implement a framework that not only helps manage the impact of climate-related risk but also emphasis the opportunities.

This article first appeared in Accountancy Ireland Magazine April 2020.

To download the report, ‘Tackling climate change: the role of banking regulation and supervision report’, visit omfif.org