IORP II and the top 10 considerations

The 10 most important issues - a trigger for Internal Audit

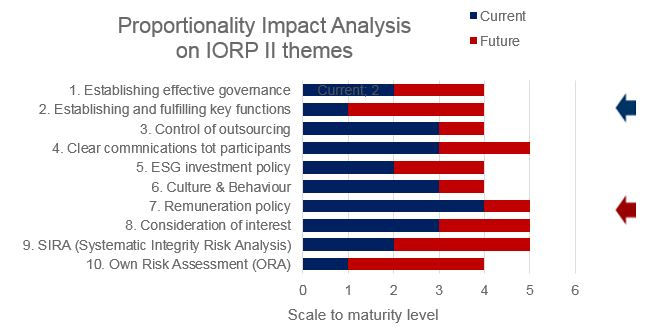

The implementation of the IORP II directive offers a reinforcement of the governance practice, but also leads to various dilemmas. In this instance we focus on the interpretation in the Netherlands. Questions such as: ‘how to set up key functions according to the nature and complexity of the fund’ or ‘what can I expect from the outsourcing of key functions’ have yet to be answered. In the chart below you can find the 10 most important themes from IORP II (maturity level included as an example). The most obvious (and perhaps most radical) changes, and their intersection with internal audit, regarding the Dutch market will be discussed in this article.

This added value lies in aspects such as the offering of an overview and providing management insight of the most important risks, the provision of a positive impulse to the controlled operation and integrity of a pension fund, and providing more transparency and greater comfort to stakeholders (and participants) through interaction with management, the other key functions and the external auditor. Download the full article.