The financial reporting of listed real estate companies in Europe – 2016 edition

For this 6th edition, we have analysed the positioning of a sample of listed real estate companies and their use of key performance indicators. We have also examined the ways they report on their asset portfolios and their financing strategies.

A very good year for the listed real estate companies

In 2014, reporting in the sector was driven by investments, disposals and large-scale operations carried out in the retail sector. It was a record year for the real estate market in France, with €24 billion euro invested, a level that was not achieved since 2006 and 2007.

2015 saw a similar picture, with investments totaling more than €23 billion.

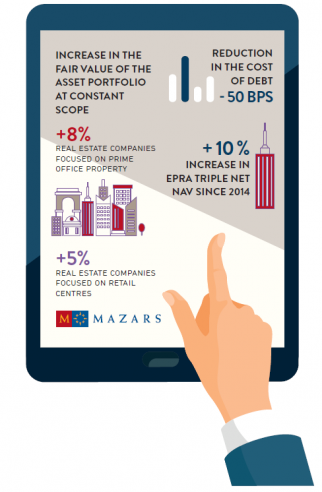

For 2016, specialists predict that investment will top €20 billion again.The compression in interest rates automatically increases the fair value of the asset portfolio.

The challenges of goodwill accounting

This edition also contains a study of a topical subject: the challenges posed by the recognition of goodwill against a background of market concentration for listed real estate companies.

An original subject reflecting the current trend in the SIIC market towards a reduction in thenumber of players as real estate companies go in search of critical mass, value creation and synergies.Will this trend towards concentration continue?