China’s New Frontier

While coastal Tier 1 megacities like Shanghai and Beijing are faced with near saturation, soaring real estate prices and quickly inflating labour costs, the nation’s efforts have been redirected towards other cities. Companies and talent are setting their sights on the promising Central and Western areas, sparking the rise and development of the so-called Tier 2 and Tier 3 cities like Wuhan and Hangzhou. Mazars is no exception: one year after our combination with ZhongShen ZhongHuan, we keep expanding in China. The Group now has a truly nation-wide coverage with nearly 3,500 professionals operating out of 30 offices across the whole country.

Premier Li Keqiang once called urbanisation a “huge engine” of China’s future economic growth [1]. However, China’s economic model has started undergoing profound shifts since these comments nearly five years ago. So it begs the question: given China’s ‘new normal’ and emerging environmental revolution, what place does urbanisation still have in the world’s second largest economic power? [1]

In the late 1970s, China was an overwhelmingly rural country with more than 80% of the population living in small, remote communities. Since then, the reforms that embraced economic liberalization paved the way for meteoric rates of urbanisation. China is now working to shift from a growth model fuelled by manufacturing and low-cost labour to a higher-value-added model driven by innovation and underpinned by strong productivity gains. Urbanization will be critical to facilitate this shift, not least by enabling economies of scale. In just the past three years, around 500 million people flocked to China’s urban centres, which currently house half of China’s population. By 2020, the country’s political leaders are aiming to achieve 60 percent urbanisation.

Urbanisation during this period boiled down to a process of expansion and this fixation sometimes came at the expense of ‘soft’ infrastructure – services to assist the urbanizing population, such as schools and hospitals. It also led to an uneven housing market across the nation. On one end of the spectrum, nearly saturated megacities like Shanghai and Beijing can barely keep pace with overwhelming demand. On the other end, hundreds of cities have almost everything modern, urbanite dreams could desire: posh apartment complexes, developed waterfronts and skyscrapers. Everything, that is, except one important element – people.

Urbanisation 2.0: What Will Change

That is why people are precisely the keystone of China’s next wave of urbanisation. Planning authorities this time have vowed to focus on populating those urban areas rather than building urban infrastructure for building’s sake. Pan Jiahua, director of Institute of the Urban Environment at the Chinese Academy of Social Sciences (CASS), has stated that Chinese urbanisation will no longer be powered by investment and industrialization. In the future, it will use domestic consumption to raise the quality of life in cities and strive to transform migrant workers into urban citizens [3]. In short, the driving force behind urbanisation won’t be expanding Chinese cities but improving them. The goal? It is ensuring that people are not just a part of the urban décor, but also enjoying the benefits.

|

Hukou reforms stand to hugely benefit migrant workers |

People are front and center in China's New Urbanisation Plan |

Beijing mapped out the next phase of that shift from countryside to the city in March 2014 as part of its 13th Five Year Plan. One of the most long-awaited tenets of the plan will grant urban residency permits, better known as hukou, to former rural residents who are now living in cities. This will guarantee them the same benefits and rights that urban dwellers enjoy. Hukou reforms also promise to spur more migration to cities while increasing the quality of life and spending power of migrants.

Accelerating the pace of urban reform should help achieve strong economic growth in China since it will bring millions more Chinese into the consumer economy — people who have so far been invisible to both Western and Chinese companies. As this new tranche of urban consumers sees its disposable income rise, traditional sectors such as agriculture, manufacturing and services are expected to be invigorated. We can also anticipate growth in sectors such as household goods, media and entertainment, e-commerce, new energy and ICT. This presents significant opportunities for multinationals to collaborate with Chinese companies in many different sectors.

Analysts at London-based ZhangSmith estimate that consumer goods and services could be worth more than US$60b every year after the plan’s end in 2020 [4]

To summarise, the country’s approach to urbanisation today is more about how to optimize what’s already in place in a way that creates a better living condition for China’s population. Some may argue that with rising property costs, over-crowding and environmental concerns, that quality of life realistically lies just beyond the western horizon. The New Urbanisation Plan seems to share this view: one of its goals is to urbanize roughly 100 million people in China’s inland regions [5]. These interior regions are already receiving greater investment and government support. The hope is to foster the healthy consumer culture of the eastern megacities throughout the central and western provinces, helping to promote its new, consumption-led economic model.

Transforming Lower Tier Cities into First-Class Business Hubs

To the trained eye, second and third-tier cities can be seen as “first-class opportunities,” given that thanks to vast amounts of government investment, new infrastructure and an influx of new talent, they have become undeniable growth drivers for the Chinese economy.

In 2001, the average income of Chinese coastal residents was 2.4 times that of their inland peers. Just ten years later, this ratio dropped to only 1.9 times [7]. Analysing this collapsing income gap between the interior and the coast paints an optimistic picture of the sustainability of China’s development. Inland cities like Wuhan are now some of the richest in the country, based on GDP per capita. This growth has attracted an increasing number of international investors, and many companies are now active in an ever-increasing proportion of these hotspots.

Second-tier cities like Chongqing and Chengdu can boast that they are home to more than 200 of the Fortune 500. Urban centres in central and Western China are not only seducing foreign businesses, but domestic ones too. Hangzhou – the capital of Zhejiang Province – for example, has been able to forge a name for itself as the “cloud capital” of China. Its local government is known to be open to creative companies and talents, which is why Alibaba, the world’s e-commerce behemoth, chose to base its headquarters there. Hangzhou is also planning to build China’s first Blockchain Industrial Park with preferential support for the companies who decide to operate within.

Why are businesses of all sizes going west and forgoing the glittering eastern coast? Many of the inland provinces offer more promising alternatives for companies being squeezed in more established centres due to intensified competition from international and domestic players. On top of this, operating costs and wages have risen dramatically in the east. Less well-known inland cities can offer a degree of alleviation to these challenges through cheaper labour and land, and even subsidies for certain types of businesses.

|

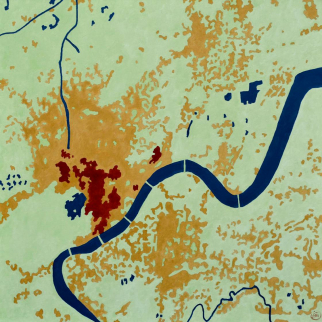

Chongqing city limits |

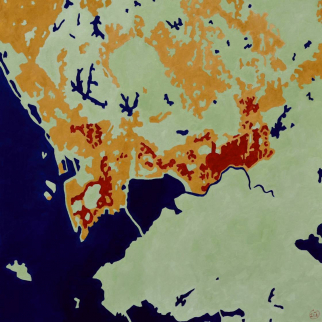

Hangzhou's central business district |

Frontier Fever: the Great Western Migration

Manufacturing – the previous engine of coastal growth – is no exception to the trend of businesses with frontier fever. This suggests that the coastal model of growth may still be applicable for inland China. “Henan and Sichuan have always been the largest sources of migrant workers. That’s why we moved to both of these provinces to tap their labour pool [directly at the source],” says Louis Woo, a spokesperson for electronics manufacturer Foxconn [8].

Many second-tier cities have been boosted by a Chinese stimulus package that has provided better highways and faster trains to increase access to these areas, signalling their growing importance to the country’s economy as a whole. Norbert Sporns is CEO of Seattle-based HQ Sustainable Maritime Industries, now operating in China’s smallest province, Hainan. He can quickly rattle off the improvements he’s seen in the area over just the past few years: two world-class airports, a 15-storey hospital just a few blocks away from their operations, a high-speed superhighway and a fortified power grid. “We can work all day and all night with no blackout periods,” Sporns says. “The rate of change in infrastructure is amazing.” [9]

Moreover, China’s massive infrastructure connectivity programme, the Belt and Road Initiative, gives cities in central and western China unprecedented access to 65 percent of the world’s population, roughly one-third of the world’s GDP, and about a quarter of all the goods and services the world moves.

Wuhan, a city of more than 10 million people located in central China, already acts as a significant transportation hub and offers a major inland river port alongside a network of rail links. It is one of inland China’s wealthiest cities but also delivers comparably cheap input costs for investors. Wuhan has dreams of becoming the car city of the People’s Republic: the automobile industry represents 20% of the city’s economy, with 200,000 direct jobs and more than a million indirectly [10]. The city stands out from its peers because Wuhan-based Dongfeng (an automotive part manufacturer) is involved in more joint ventures with foreign firms than any other state-owned organisation.

|

Qingchuan Bridge in Wuhan |

Wuhan - the "motor city" of China? |

For young graduates, a land of opportunity

Increased urbanization in the inland provinces is translating into a need for more workers. Chinese workers are eager to flock to these fast-growing cities, giving companies access to a new level of talent and skills. Competition to attract top talent to China’s largest cities is becoming increasingly heated, rolling out preferential policies promising graduates housing discounts, streamlined household registration, and even cash handouts.

A survey from Zhaopin.com, one of China’s leading recruitment websites, shows 37.5% of China’s new university graduates in 2017 want to work in second- and third-tier cities, abandoning the eastern megacities. [11]

Wuhan recently issued a series of measures to let more graduates buy or rent houses at prices 20 percent lower than market rates. Generous subsidies are also offered in Changsha, the capital city of Central China’s Hunan province.

“Initially, it was hard to get good people to locate here, because they thought it was too much like camping,” Sporns says. “Now [inland provinces] are becoming quite cosmopolitan as a result of the influx of new people from all over China.” [12]

A New Tranche of Consumers

With the influx of new workers and industries, second-tier cities are also becoming thriving places of commerce, as evidenced by major retailers’ expansion into these cities. Wal-Mart Stores, Inc. opened its first super center in Shenzhen in 1996, and expanded to 189 stores in 101 cities throughout China by August 2010. Home Depot now operates 12 stores in six Chinese cities, including Qingdao, Tianjin, and Xi’an. Burberry has stores in over 30 cities and Zara has 140 outlets across the country. This means that China is now dotes with a much more geographically diverse customer base than ever before.

Once-sleepy Kunming — long a stopping-over point for itinerant backpackers — has quietly become one of the most lucrative luxury markets in southwest China. In recent years, brands like Louis Vuitton, Cartier, Max Mara and Burberry have set up shop in fast-growing Kunming, which has benefited from increased trade with neighbouring Vietnam, Laos and Myanmar. This cross-border commerce should continue to thrive as Kunming is set to become the starting point of a planned railway network winding through Indo-China to Singapore.

Mazars in China: same quality, better coverage

As China’s economic centre of gravity moves inland, the inland provinces will be able to contribute more to GDP growth. From 2001 to 2011, inland China contributed to 46% of the growth in real GDP, compared to 40% over the previous 10-year period [13]. Regional economic development patterns, therefore, point towards an auspicious outlook for the Chinese economy.

Mazars also believes in this potential, for our Group and our Chinese and foreign clients. One year after our combination with ZhongShen ZhongHuan, our expansion in China continues. Mazars ZhongShen ZhongHuan now offers a truly nation-wide coverage with nearly 3,500 professionals working in of 30 offices across the whole country – including those in new and upcoming inland urban areas.

Even if growth in any emerging economy must eventually slow down, a look inland shows that the mini-countries we call Chinese provinces to have promising futures that will help sustain the nation’s development.

A stated aim of the New Urbanization Plan is to bring foreign investment into China. With a sizeable market opportunity on the table, the onus will be on Western firms to find and seize the moment. However, there will be competition for many of the contracts. Therefore, it is crucial for companies hoping to operate in China to foster good relationships with the regional Chinese governments who will be performing the selection. Mazars ZhongShen ZhongHuan’s wide-spread implantation has allowed us to “form solid ties with local political bodies throughout the nation, as well as to develop in-depth knowledge of local regulations governing how both foreign and domestic organizations can work in the country,” says Nikko Fu, Mazars Partner in charge of Global Chinese Services.

With a comprehensive array of professionals and services, we have the full ability to help our clients capitalise on growth opportunities in all of China’s most promising regions – and beyond. Mazars ZhongShen ZhongHuan will keep continuing to optimise its business structure and work harder to promote innovation-driven development.

1 https://www.chinadialogue.net/article/show/single/en/8808-Interview-What-does-urbanisation-mean-for-China-s-economy-

2 https://www.chinabusinessreview.com/the-business-of-urbanization-in-china/

3 https://www.chinadialogue.net/article/show/single/en/8808-Interview-What-does-urbanisation-mean-for-China-s-economy-

4 “China: planning for an urban future.” Mak, Y.P, QI, M. Tang, C.M., and Wang, C.Y. EYGM Limited. 2014.

5 https://www.mckinsey.com/global-themes/urbanization/infrastructures-central-role-in-china-new-urbanization

6 http://online.wsj.com/ad/article/chinaenergy-cities

7 https://qz.com/112920/how-chinas-poorest-regions-are-going-to-save-its-growth-rate/

8 idem

9 http://online.wsj.com/ad/article/chinaenergy-cities

10 https://www.theguardian.com/world/2015/apr/06/wuhan-china-car-automobile-industry

11 http://www.chinadaily.com.cn/china/2017-10/14/content_33236115.htm

12 http://online.wsj.com/ad/article/chinaenergy-cities

13 https://qz.com/112920/how-chinas-poorest-regions-are-going-to-save-its-growth-rate/