The new standard IFRS 15 on Revenue recognition for construction, civil engineering and real estate development industries

IFRS 15 for the Real Estate Sector

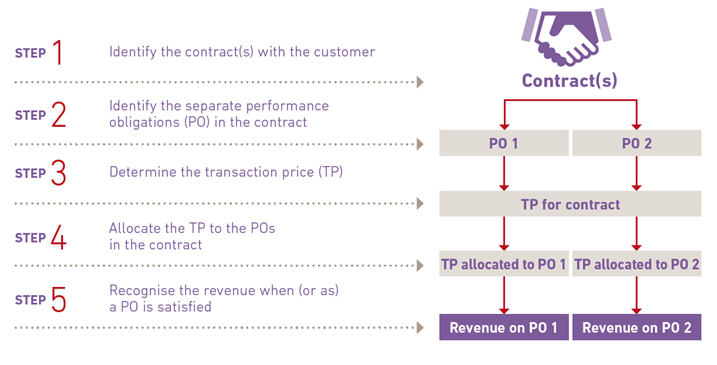

This standard relies on the concept of transfer of control to recognise revenue, rather than on risks and rewards as previously. It requires a contract to be broken down into distinct performance obligations, each with their own margin and pattern of revenue recognition.

Could IFRS 15 therefore call into question the recognition of revenue according to the stage of completion, or lead to a change in the pattern at which revenue and/or the margin is recognised?

We have analysed the 5-step recognition model set out by IFRS 15 and highlighted its implications for the real estate sector.