2015 edition: key points of the financial communication of insurance groups in Europe

2015 financial communication of insurance groups

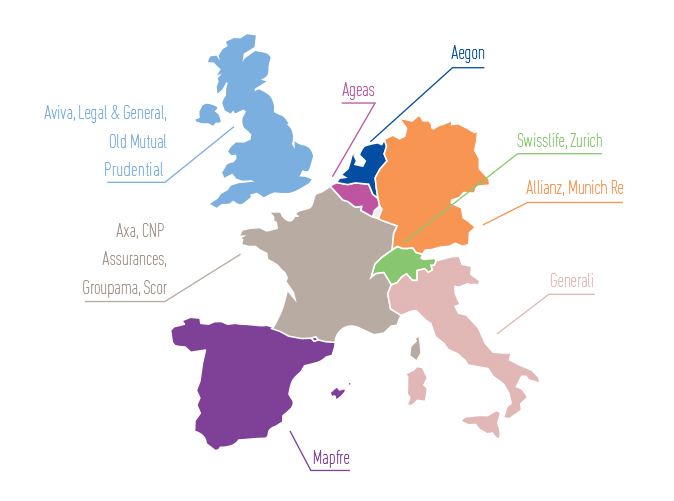

Like last year, our survey considers the financial disclosures of a sample of 16 European insurers and re-insurers on the basis of their annual reports and their financial reporting material at 31 December 2014.

This year we have focused on the following topics:

- the strategic plans of insurance groups: an analysis of the indicators used and the main messages conveyed;

- the impact of the first application of the new standards on the ‘consolidation package’ on financial communication;

- the disclosures provided by insurers on the impact of persistent low interest rates in Europe;

- disclosures on goodwill, the associated recoverability tests and disclosures associated with other intangible assets;

- insurers’ communication on financial instruments, including derivative instruments, and the issues associated with the market environment;

- communication on embedded value and the main performance indicators; and

- disclosures on capital management against a background of regulatory reform.

We have sought to shed light on the comparability, comprehensibility and relevance of disclosures, both under IFRSs and the other conceptual frameworks to which our analysis will refer.

Composition of the sample

Our sample consists of the following 16 European insurance and reinsurance groups that publish their accounts under IFRSs: